Finance Promotes Consumption Diversity

Consumers across China are loving the benefits of vibrant financial innovations fueling everyday spending. With services such as easy-to-use mobile applications, consumers can easily apply for loans and receive funds instantly, while using credit cards for payments comes with added perks including discounts on dining.

Recently, a set of new measures to further strengthen financial support for consumption have been released by six key Chinese government bodies, including the People's Bank of China and the National Development and Reform Commission.

More buying power

At the heart of the policy is the focus on increasing consumers' purchasing power and fostering demand. By intensifying financial support for the real economy, the measures emphasize coordinated efforts among monetary, fiscal, and industrial policies. Maintaining ample liquidity and lowering comprehensive social financing costs are viewed as pivotal steps in enabling consumption to play a vital role in facilitating domestic economic circulation.

The policy highlights the importance of raising both current incomes and future income expectations to inject stronger and more confident market dynamics, encouraging consumers to spend more. Special emphasis is placed on strengthening financial services for private enterprises, small and micro businesses, and individual entrepreneurs — key drivers of employment. Measures include deepening the implementation of entrepreneurial guarantee loans, simplifying approval procedures, and fostering income growth through entrepreneurship.

Expanding credit facilities

To support greater consumption, the document calls for improving professional service capacities of financial institutions. Credit remains the primary financing channel, with encouragement for institutions to optimize internal structures, build expert teams, and innovate credit products. Increased lending support will be directed toward eligible businesses in consumption-related sectors, including first-time loans, renewals, credit loans, and medium- to long-term financing.

The policy also encourages bond market financing, enabling companies serving consumption sectors to issue bonds. Efforts to broaden opportunities for securitisation of retail loan assets —covering personal auto loans, consumer credit, and credit cards — are underway, improving financial supply diversity to meet multifaceted consumer demands.

Funding key consumption areas

Unlocking consumer potential requires targeted financial backing in critical consumption domains. To stimulate goods consumption, the policy promotes financial services facilitating trade-in programs for consumer goods, increased loan support for enterprises involved in dismantling scrapped vehicles and recycling old appliances, and expanded auto loan businesses.

In promoting service consumption, the measures advocate for increased credit allocation to wholesale and retail, catering and hospitality, and home services. Innovative financing models will be explored in cultural tourism, sports, and entertainment sectors. Additional emphasis is placed on nurturing emerging consumption patterns — such as digital, green, and health-related consumption — through financial innovation and development of new products tailored to these trends.

Hybrid consumption ecosystem

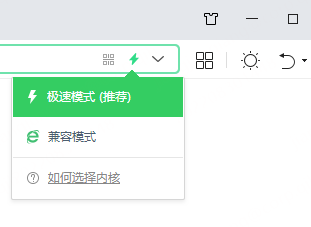

The policy acknowledges the importance of improving the overall consumption environment by streamlining payment services and enhancing convenience to meet the needs of diverse consumer groups. A hybrid approach of online services complemented by offline support is promoted.

Leveraging Internet technologies, big data, and mobile platforms, the policy advocates for deep integration between financial services and consumption scenarios. Expanding online financial channels, strengthening offline financial support, and providing swift, accessible consumer finance are seen as vital to creating a seamless, efficient consumption ecosystem.